Options Education Center

Explore Strategies

Learn more

Upgrade Options Level

Learn more

Trading Zero Days to Expiration (0DTE) Options

Zero Days to Expiration (0DTE) Options are options contracts set to expire at the end of the trading day. This applies to all options contracts, regardless of the date they were issued, whether months or weeks ago.

Traders seeking 0DTE options often turn to Weekly options introduced by the CBOE in 2005. Initially, these options expired every Friday, but the exchange expanded to three expirations a week and eventually to five days a week on certain indexes.

Weekly options have characteristics and features similar to standard options, such as pricing, assignment, exercise, rights, and obligations. A noticeable difference between weekly and standard options is that weekly options have a shorter expiration cycle. They share many other characteristics with standard options. For a complete list of available Weeklys, refer to CBOE Weeklys.

Due to their short time frame, 0DTE options are sometimes traded using credit strategies, capitalizing on positive Theta and time decay. Due to the complex nature of these products, an option level of four or above is required. TradeStation clients with an options trading level of three or less can only use debit strategies when trading 0DTE options.

Five features of 0DTE options

No overnight risk

Trading same-day expirations eliminates the risk of carrying positions overnight.

Lower time value can mean lower premiums

0DTE options have lower premiums than options with more time until expiration. Their suitability would depend on your strategy and risk tolerance.

Liquidity

Due to their increasing popularity, 0DTE options on certain underlying have a lot of trading volume and liquidity.

Know the outcome quickly

Since options expire on the same trading day, you promptly know the success or failure of your trade.

Flexible trading

0DTE options allow you to take advantage of short-term price movements or react quickly to news events, offering greater flexibility and customization in trading with leverage.

Five concerns for 0DTE options

Time decay

With only the same trading day, any time value in 0DTE options will decay rapidly. While advantageous when using credit strategies, it poses a challenge for other approaches.

Gamma risk

Shorter expirations are more sensitive to underlying price changes. Minor changes in the underlying price can lead to more significant changes in the option’s value.

Large price movement needed

Debit strategies applied to 0DTE options require a substantial price movement within the same trading day, sufficient to cover the cost (premiums) of the position.

Overtrading

Because there are more option expirations available, there could be the temptation to trade more often. This could result in overtrading, where additional costs are created, and lowerquality option positions are entered.

Active trade management required

Debit spreads traded on 0DTE options can be exited before the end-of-day expiration to realize a profit. Credit strategies can profit when allowed to expire out of the money, but implementing a stop loss can be used to manage risk exposure when the trade deviates from expectations.

| Quick reference guide: Debit strategies on 0DTE options | |

|---|---|

| Market outlook for debit strategies | Anticipating a sharp price move in either direction and/or increased volatility |

| Position net debit or credit | Debit (premium paid) |

| Maximum profit | Vertical spreads: Difference in strikes minus the premium paid Long call, straddle, & strangle: Unlimited upward Long put, straddle, & strangle: From the strike price to zero downward |

| Profits from | The underlying price moving significantly and rapidly |

| Maximum loss | Premium paid to enter the position, occurs if the options expire worthless |

| Breakeven | Bullish: the long strike plus the premium paid Bearish: the long strike minus the premium paid |

| Risk from | The underlying price not moving sufficiently to cover the cost of the position and/or a decline in volatility Overtrading Early assignment on the short leg for spreads |

| Quick reference guide: Credit strategies on 0DTE options | |

|---|---|

| Market outlook for credit strategies | Bear call spread: Expecting a drop in the underlying price Bull put spread: Awaiting a rise in the underlying price Iron condor/butterfly: Anticipating price to move sideways in a channel and/or a drop in volatility |

| Position net debit or credit | Credit (premium received) |

| Strategies available | Bull put spread, bear call spread, iron condor, iron butterfly |

| Maximum profit | The premium received |

| Profits from | The short strikes remaining out of the money when the options expire |

| Maximum loss | Vertical spreads: The difference between the short and long strikes minus the premium received Iron condor & butterfly: The largest spread width (distance between the short strike and long strike), minus the premium received |

| Breakeven | Bullish: the short strike minus the premium paid Bearish: the short strike plus the premium paid |

| Risk from | The underlying price moving beyond the breakeven price or an increase in volatility Maximum loss occurs if the underlying price is beyond either long strike at expiration Overtrading |

Option style

American style options

Option buyers/holders have the right to exercise the options at any time up to the expiration. Typically, ETFs and equity options are American style.

European style options

These options can only be exercised at the expiration date. The options will be automatically exercised if they expire in the money by at least a penny.

What happens at expiration?

The outcome at expiration will depend on several factors:

The type of option being traded

- Options on equities and ETFs are physically delivered.

- Index options are cash-settled.

Whether it is a call or a put option

The moneyness of the option

Actions at expiration

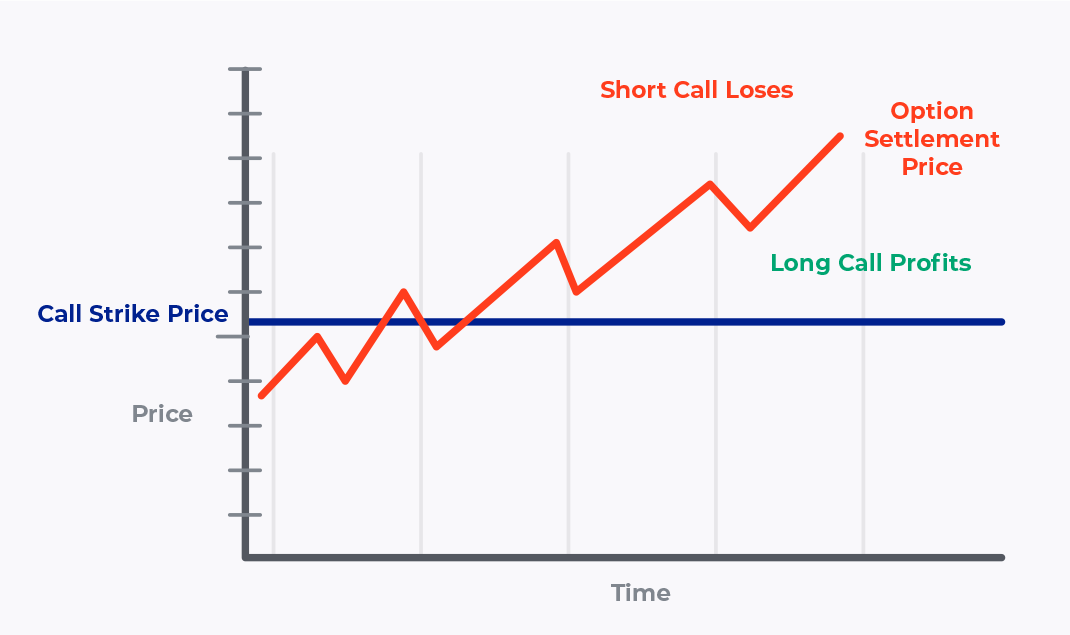

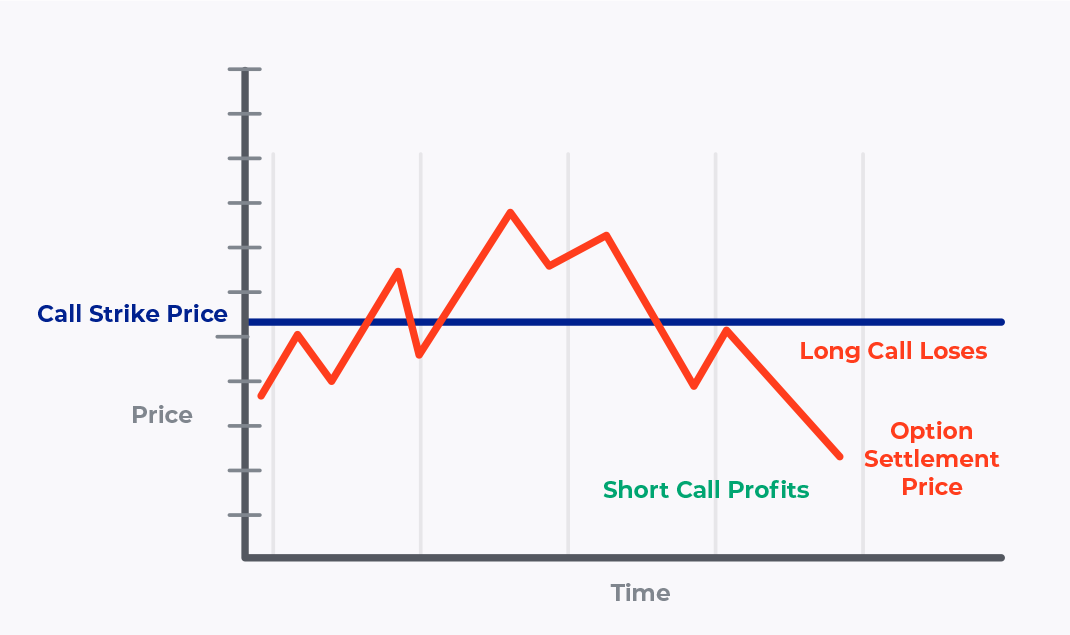

Long call

- In the money: The option will be automatically exercised if the settlement price is above the strike price by at least $0.01. For stock and ETF options, the trader must purchase 100 shares per contract at the strike price or liquidate and sell the stock position the next business day. The profit would be credited to the buyer’s trading account for cash-settled index options.

- At the money or out of the money: The trader would lose the premium paid for the option.

Short call

- In the money: The seller is automatically assigned, and for stock and ETF options, they would have to deliver the 100 shares at the strike price for each contract. For index options, the seller’s account would be debited the amount of the loss based on the difference between the settlement price and the strike price.

- At the money or out of the money: The option expires worthless, and the trader keeps the premium received.

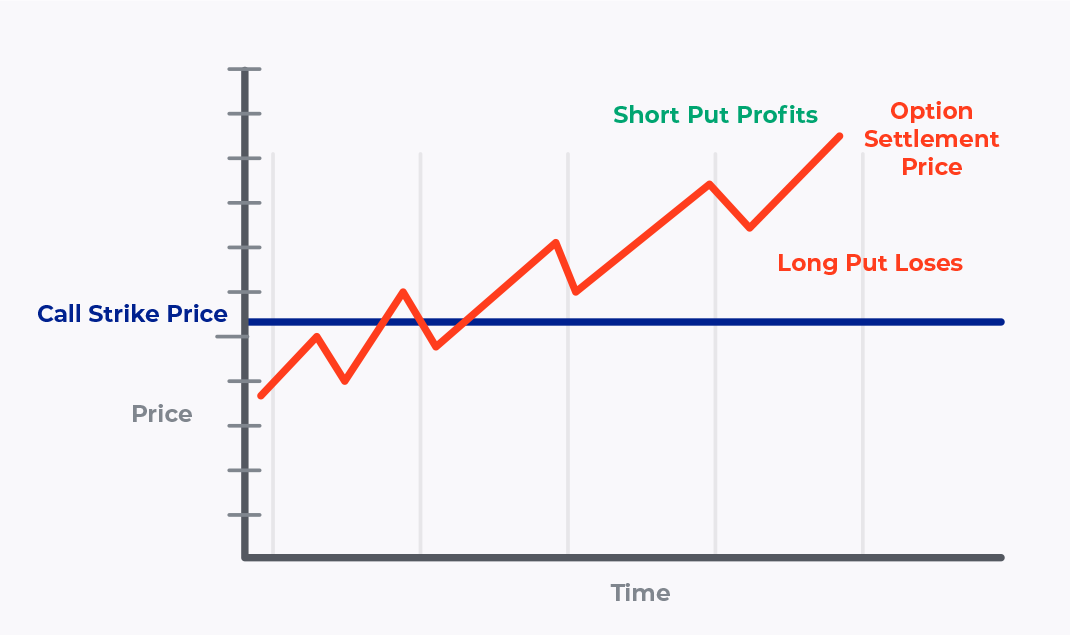

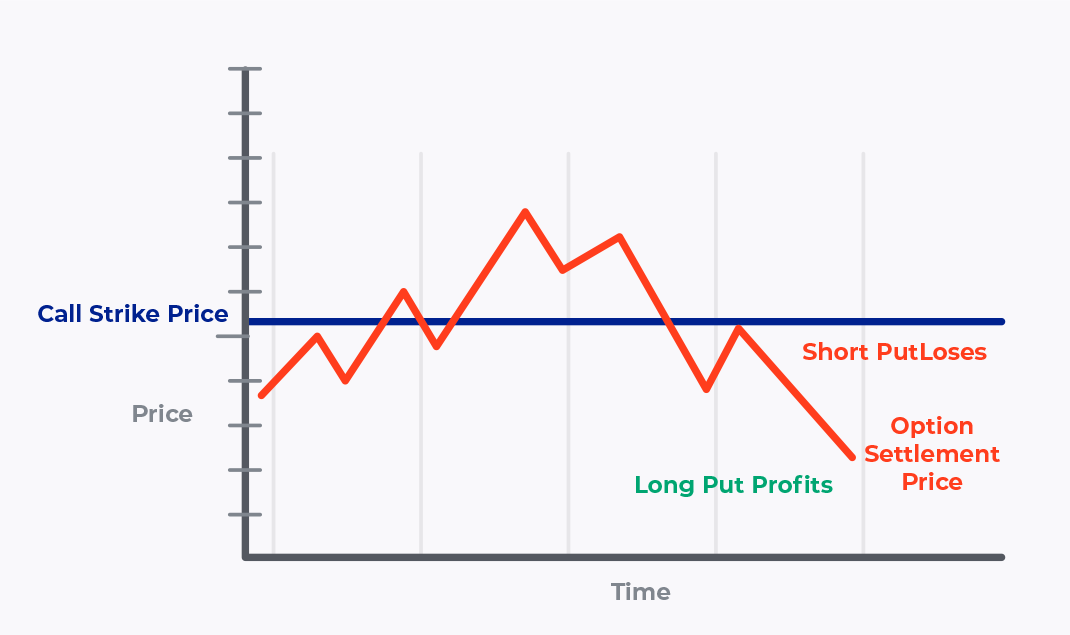

Long put

- In the money: The option will be automatically exercised if the settlement price is below the strike price by at least $0.01. The trader must sell 100 shares per contract at the strike price for stock and ETF options. With index options, the profit would be credited to the buyer’s trading account.

- At the money or out of the money: The trader would lose the premium paid for the option.

Short put

- In the money: The seller is automatically assigned, and for stock and ETF options, they would have to buy 100 shares at the strike price for each contract. With index options, the seller’s account would be debited the amount of the loss based on the difference between the settlement price and the strike price.

- At the money or out of the money: The option expires worthless, and the trader keeps the premium received.

When to use 0DTE options?

Traders may opt for debit strategies on 0DTE options when anticipating a substantial, rapid price movement in the underlying during the day. Additionally, debit strategies on 0DTE options can benefit from increased volatility.

Traders with options trading level four or higher can sell credit strategies on an underlying they expect to have little to no price movement or a drop in volatility. Credit vertical spreads can be used when a price move is anticipated and volatility is high and expected to drop.

Example

Let’s compare 0DTE options versus standard options for trading around a market event. We will create a hypothetical situation using the S&P 500 index as the underlying security. We will compare the trades from Pat and Sam, two traders expecting a large price movement down from resistance resulting from an economic announcement in the late afternoon.

Both traders see a resistance level near 4980 to 4983 and are targeting support around 4965. To take advantage of the large, expected price movement, they both place 4980/4965 bear call spreads.

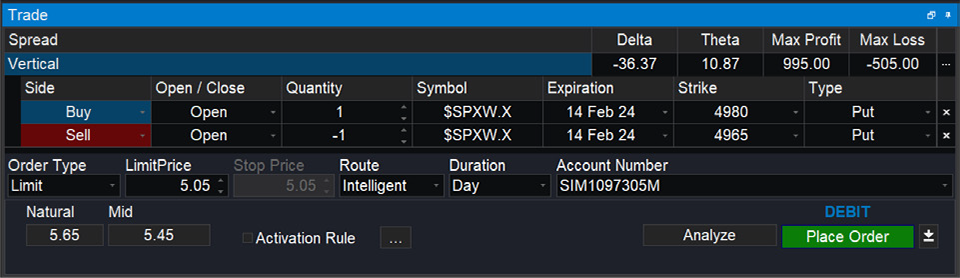

Pat traded the spread using 0DTE options.

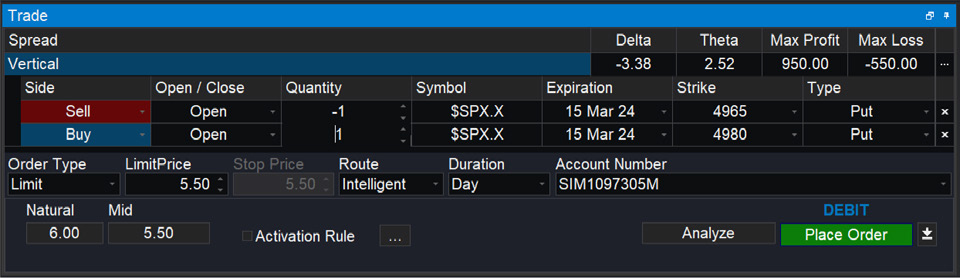

Sam placed the trade with standard SPX options with 29 days to expiration.

To simplify, we assume both traders were filled at the mid-price shown in the orders. The trades would be exited on the same day once the index dropped to the target of 4965.

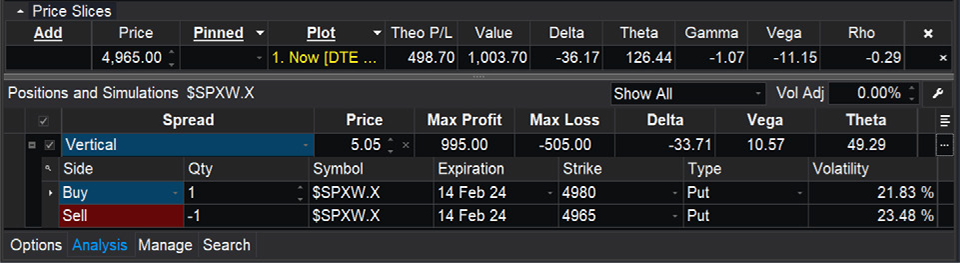

With OptionStation Pro, we can use the price slice tool on the analysis page to theorize the potential profit if the index price does reach the target. This only considers price movement and does not reflect changes in volatility or other influences. Looking at Pat’s 0DTE options spread, there is a theoretical profit of $498.70.

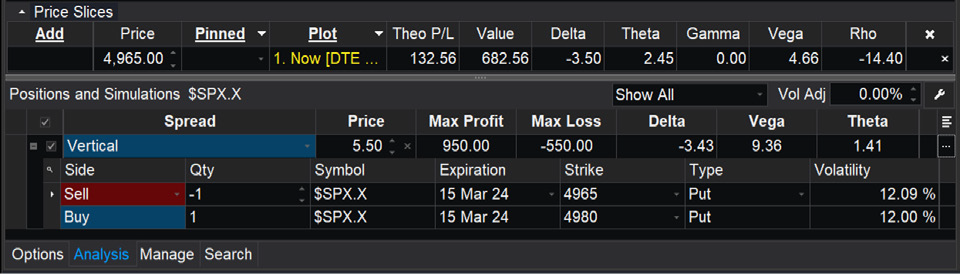

Sam, trading standard options spread, shows a theoretical profit of only $132.56.

Let’s compare and contrast the results

| Pat | Sam | |

|---|---|---|

| Strategy used | 4980/4965 bear put spread | 4980/4965 bear put spread |

| Options selected | 0DTE options | Standard, 29 days to expiration |

| Cost of options | 5.05 x 100 = $505 | 5.50 x 100 = $550 |

| Max loss | -$505 | -$550 |

| Max profit | $995 | $950 |

| Position’s Delta at open | -36.37 | -3.43 |

| Potential realized profit at 4965 | $498.70 | $132.56 |

| Rate of return | 98.8% | 24.1% |

Pat received a much higher rate of return than Sam. The costs of entering the trades were very similar. But there is a much higher Delta with the 0DTE options. The expiring options also have greater Gamma, and the position would not be affected by much time decay since it was closed the same day before the expiration.

Practice

Access the TradeStation platform in Simulated Trading mode to practice placing trades on 0DTE options without any real money at risk. Through this practice, you can familiarize yourself with analyzing options, implementing strategies, and executing orders.

Conclusion

Traders can use 0DTE options strategies around specific market events, such as an earnings announcement or news. The shorter duration of these options results in lower premiums when compared to options with more time until expiration, potentially offering greater returns.

Less time before expiration means less time for an underlying security to move in price. Therefore, options sellers could exploit this limited time to manage risk effectively when trying to generate income from collecting premiums.

Ultimately, understanding the unique features of Zero Days to Expiration (0DTE) Options can contribute to more informed and potentially profitable trading strategies.

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing. for full details on the costs and fees associated with options.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID3423734D0324