Most people know technology and communications stocks are having a rough quarter. But not every stock is going down. Twitter (TWTR) rose 21 percent between September 30 and yesterday's close. That made it the second-best performing company in the entire S&P 500...

Call toll-free 800.328.1267

Market Insights

Opportunity knocks for those with trading in their DNA.

Curiosity creates opportunity. Insights create strategy. Born traders create their destiny.

Why Stocks Move: Credit

This post is part of a series about the catalysts for stock movements. It’s based on a series of talks at TradeStation’s Master Class learning sessions. Credit events might be rare, but they can trigger big stock moves. Traders looking to...

This Tool Keeps You on Top of the Market with VWAP

Market pros use VWAP. Do you? We're talking about the volume-weighted average price. Institutional traders have used it for a long time to know where they stand versus everyone else in the market. Unlike a simple average based on time, VWAP is weighted by volume. More...

Catch Volatility with Trailing Stops

"The times, they are a-changin'." But you don't have to be a rock star to know that with the markets on the move, you could miss out if your trades stand still. Trailing stop orders have long been a secret weapon that advanced traders use to catch profit from...

How to Find Momentum Pullbacks on a Day Like Today

Today's a rough day for most bullish investors. But there are ways to turn those lemons into lemonade thanks to TradeStation's powerful functionality. RadarScreen®, our ever-useful, do-anything tool, powers the workspace below. It contains a list of companies in the...

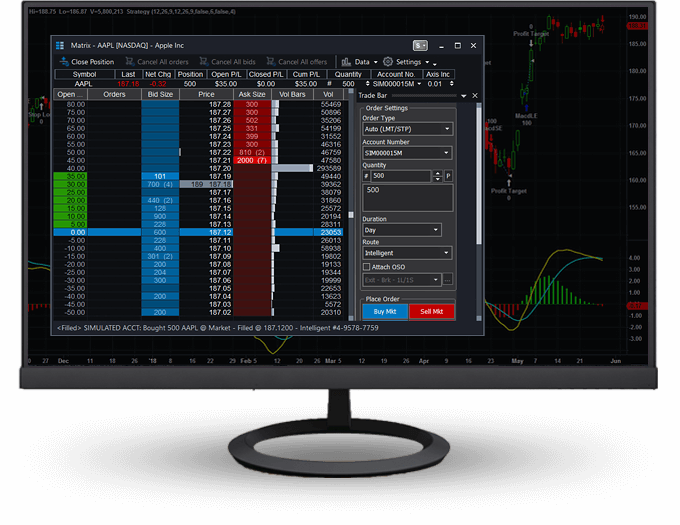

Matrix Lets You Trade the Market at a Glance

TradeStation's arsenal of trading and analysis tools gives you advantages once enjoyed only by professional traders. One of our most popular features is the Matrix. It lets you see market activity at a glance and instantly place trades at the price level you want. A...

Popular Chip Stock Holds Key Level Into G20

One of the most heavily traded names in the chip space is holding a potentially key level. Micron Technology (MU) dropped 38 percent from the start of June through yesterday. But now the giant producer of memory circuits is holding its ground above $36.50, an old peak...

Bullish Chart Patterns Across Big Pharma

Everyone's been focused on the selloff in tech, but something more bullish may be happening in a forgotten corner of the market. Large pharmaceutical companies including Pfizer (PFE), Merck (MRK) and Amgen (AMGN) have formed triangles in recent weeks. The...

Why Stocks Move: Margins

This post is the fourth in a series about the catalysts for stock movements. It’s based on a series of talks at TradeStation’s Master Class learning sessions. Most investors want to see companies making money on a regular basis. Today we'll look...