Options Education Center

Explore strategies

Learn more

Download workspace

Download

Upgrade options level

Learn more

Trading downtrends effectively with bear put spreads

A bear put spread is a multi-leg options strategy designed to help investors capitalize on anticipated stock price declines and benefit from increased volatility. The accompanying video above reveals the many features of the multileg strategy over the single-leg alternatives such as the long put or shorting stock shares. This article highlights these features, providing insights on how to place and manage the bear put spread.

A strategy comparison

Let’s consider a hypothetical trading scenario involving traders LP (Long Put), SH (Shorting), and BPS (Bear Put Spread) to evaluate the various strategies that attempt to profit from a bearish market move. Our imaginary traders believe that WOLF stock will likely move up to resistance near $40.00 before dropping in price, targeting a support level of around $29.00. Trader LP (Long Put) opts for their simple long-put strategy, trader SH (Shorting) chooses to short the stock shares, and BPS (Bear Put Spread) employs the bear put spread. Let’s assess the strategies to determine their effectiveness.

Trader LP

Trader SH

Trader BPS

Trade comparison

| LP’s trade | SH’s trade | BPS’s trade | |

|---|---|---|---|

| Strategy used | Long Put | Short Stock* | Bear Put Spread |

| Debit (premium paid) | $9.00 | $1,932 margin 50% required | $7.75 |

| Maximum loss | $900 | Unlimited | $775 |

| Breakeven price | $31.00 | $38.64 | $32.25 |

| Maximum profit | $3,100 | $3,864 | $725 |

| Realistic profit at target ($28.69) | $231.02 | $995 | $356 |

| Rate of return at target | 25.7% | 51.5% | 45.9% |

*Assumes short entry at $38.64 and targeting $28.69 for profit.

**Commissions and fees are not included.

Traders often choose the long put strategy due to its potential for higher profits. However, the bear put spread presents several potential advantages:

Lower maximum loss

Lower breakeven price

Higher potential profit at the target

Possible higher rate of return on the investment if there is a lower entry cost

| Quick reference guide: Bear put spread | |

|---|---|

| Market outlook | Bearish |

| Position net debit or credit | Debit (premium paid) |

| Number of legs | Two – one long put, and one short put |

| Maximum profit | High strike minus the low strike minus the net premium paid |

| Profits from | Underlying price moving down to or below the low strike price |

| Maximum loss | Premium paid if both options expire worthless |

| Breakeven | Higher strike minus the premium paid |

| Risk from | Underlying price rising to or above the strike of the long put or assignment on the short put before expiration |

| Options level required | Level 3 – click here for additional information |

What is a bear put spread?

A bear put spread is a trading strategy that involves two actions:

Buy a put option

This leg drives the position’s profit. The long put’s value can rise with a decline in the underlying price or with heightened volatility. The trade profits when the put is sold at a higher price than its initial purchase. While a closer strike to the underlying price entails a higher premium, it also increases the likelihood of the option finishing in the money.

Sell a lower strike put option

This leg is sold simultaneously with the long put. The short put caps the position’s reward, but the premium collected offsets some of the buying cost.

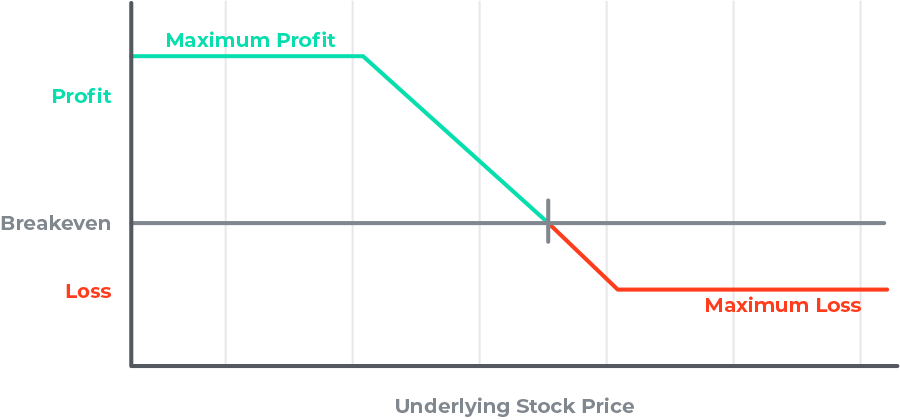

Bear put spread risk/reward profile

Bear Put Spread

Reward

High strike minus lower strike minus premium paid times 100.

Breakeven

Higher strike minus the premium paid.

Risk

Debit paid to open the position.

Situations suited for a bear put spread

Consider a bear put spread when you are negative about a particular stock but want to mitigate potential losses, especially if you anticipate the stock not to drop below the lower strike price.

Here are some situations where a bear put spread may be used:

Moderate bullishness

When you believe the stock’s price can drop down to or near a support level.

Lower cost

To profit from a bullish move at a lower cost than if you bought a call or the stock alone.

Lower cost

To profit from a bearish move at a lower cost than if you bought a put or shorted the stock.

Limited risk

To limit your potential losses by selling a put and lowering the cost of buying another.

Strike selection

The long put strike should be at or near a resistance level. The premium paid to buy the option is usually lowest when the price is in or near the resistance. The short strike should be at or below a support level where you do not think the price may reach or exceed before the position is exited.

How to place a bear put spread trade

Select a stock

Identify a stock expected to drop in price or remain steady.

Choose strike prices and expiration

Pick two put options with different strike prices, ensuring the short put has a lower strike. Both options should share the same expiration date.

Considerations

- The strike of the put that is bought determines the position’s risk because the premium paid is the potential loss. The premium collected from the short put will be subtracted from the premium of the long put. The maximum loss is the difference between the strikes minus the premium collected

- The strike of the sold put should be as high as possible to collect a premium, but far enough from the long strike to allow for profit. The maximum profit is the difference between the strikes minus the premium paid.

- Because this is a debit spread, time decay works against the position. To avoid exponential time decay, expirations that are greater than sixty days out should be chosen, and the position should be closed approximately thirty days before expiration. Time decay increases exponentially within the last thirty days before options expiration.

- Choosing shorter expirations or using deeper out-of-the-money put options may cause losses or smaller profits due to greater time decay or a lower delta. The lower delta means the premium will not respond as much to changes in the underlying price. A bear put spread lowers the cost of an at-the-money put and provides a better delta.

Exiting the bear put spread

Close the spread by selling the bought put and buying back the sold put option. Profit is realized if this is done at a higher value than the premium paid when the spread was opened.

Since time decay works against the position’s profitability, consider closing the spread approximately 30 days before expiration. A smaller profit would be made if the underlying price did not reach the lower strike.

If the underlying stock price is above the strike of the long put option, and there are only 30 days until expiration, the spread can be closed. This would result in a loss that is less than the maximum, attributable to the time value of the options.

Test before you trade

Access the TradeStation platform in Simulated Trading mode to acquaint yourself with strategy analysis and order entry. Utilize this environment to practice placing bear put spreads without exposing real money, allowing you to gain confidence in executing the strategy.

Conclusion

The bear put spread is a valuable strategy for investors seeking to profit from expected stock decreases while managing risk. This involves buying a put option and selling a lower strike put. The strategy aims to benefit from increased volatility and underlying price movements. It offers limited rewards and potential losses, necessitating careful strike selection and vigilant trade monitoring. Traders typically close the spread before option expiration to mitigate maximum time decay.

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing. for full details on the costs and fees associated with options.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID3406238D0224