Options Education Center

Explore Strategies

Learn more

Upgrade Options Level

Learn more

Placing activation rules on options orders

TradeStation’s Activation Rule is an order feature that allows you to determine when an order will be sent to the market. This activation can be based on a specified time or price action of one or more symbols. Activation rules for a given order are defined using the Activation Rule dialog.

The Activation Rule dialog allows you to add a time trigger, price trigger, or both to your spread order. Up to four equity, option, or index symbols can be added to the activation rule logic. This feature can be used for entry, take profit, and stop-loss orders in options.

Features of activation rules

Timing of orders

Time-based activation rules can trigger orders at designated times without you being in front of the computer.

Bracketing positions

Multiple price activation rules can be set to deploy a closing transaction when a profit target or a protective stop loss level is reached.

Emotionless trading

Activation rules will send orders based on your predefined conditions and will not hesitate or overthink.

Concerns when using activation rules

Regular session limitation

Activation rules are only active during the regular session. After creating the order, a time-based activation rule will only be used during the first active session.

Same day for time-based

The time-based activation rule will only be used during the current active session after creating the order. It will not carry over to the next trading day.

No guarantees

There is no guarantee that this feature will prevent scenarios such as a bad price tick triggering a stop order or a bad stop order fill price.

When to use an activation rule

Entry orders

Strategic timing

The activation rule can delay the placement of an entry order until after an announcement or economic data release.

Support/resistance levels

Place the entry order once the price has reached a support or resistance level.

Stop loss orders

Price-based trigger

The activation rule can be set to place a stop loss if the underlying price reaches a certain level.

Option premium conditions

The activation rule can be set to activate the stop if the option premium rises or drops to a specific price.

Market close exit

Traders who do not want to hold a position overnight can send a market order to exit their position before the market closes.

Profit target orders

Price-based exit

The activation rule can place an exit order if the underlying price reaches a certain level.

Option premium conditions

The activation rule can place an order to exit if the option premium reaches a particular price.

Time-triggered activation

The order activation can be triggered based on time, such as just before the market closes.

Attaching an activation rule to an order

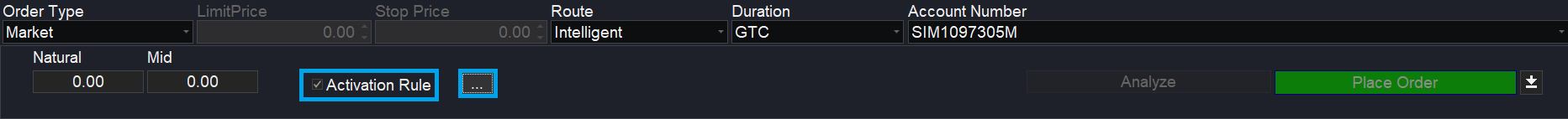

The activation rule feature is found on the Trade Bar. To attach it to an order, click the box to the left of the words “Activation Rule.” The ellipsis button to the right opens the menu to enter the criteria.

How to place time-based activation rules

In the activation rule menu, place a checkmark in Time. Enter the time the order is to become active and click ok to save the time rule. Note the time used is your local time and not the exchange time. The time-based activation rule will only trigger during the current active session after creating the order. Only price-based conditions will continue to work on successive sessions for GTC orders.

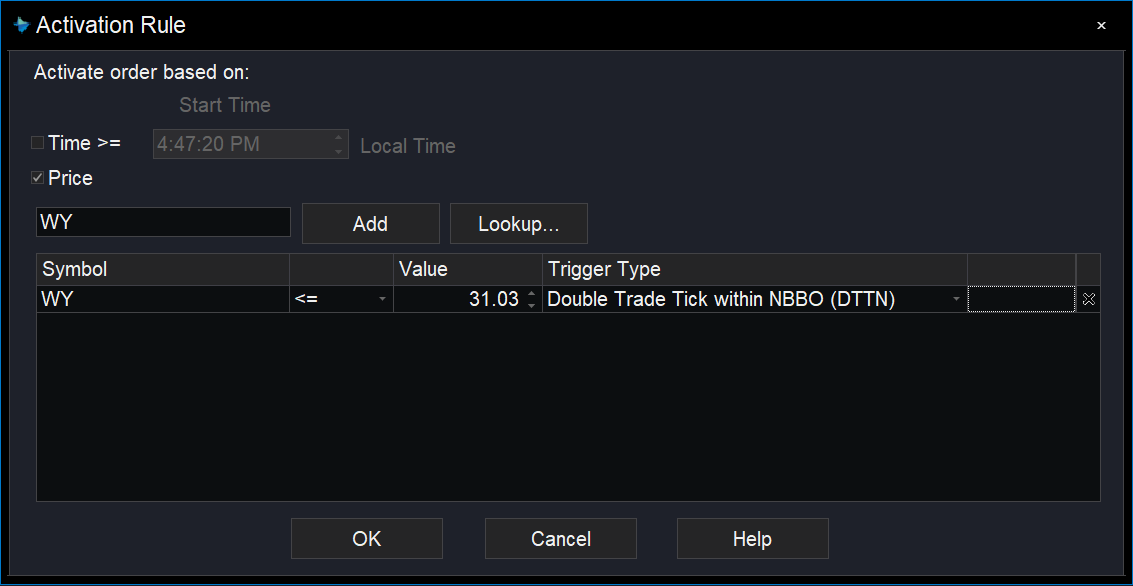

How to place price-based activation rules

In the activation rule menu:

Place a checkmark in Price

In the box below, enter the security symbol to trigger the activation. If you do not know the symbol, you can look it up. Symbols can be looked up by the company name or a portion of the complete symbol. The specific option symbol can also be searched.

The symbol will appear below. Select the conditional operator (>, >=, <, <=) and the value, which is the target price.

You can add up to four price conditions for the activation rule. Click “Add” to create new condition lines, and use the X on the right to remove them.

Use the ‘and’ and ‘or’ expressions on the right of each line to change how multiple price conditions are combined.

- Using ‘and’ will make every condition necessary to activate the price rule.

- Using ‘or’ will trigger the price rule if any conditions are met.

Click OK to save the price activation rule.

Trigger types

Triggers specify the price pattern that will trigger a stop order, an if-touched order, or an activation rule. This feature is designed to help the trader mitigate the risk of a bad price tick inadvertently triggering a stop order.

While this feature aims to reduce such risks, there is no guarantee that it will prevent all instances of a bad price tick triggering a stop order or prevent a bad stop order fill price.

Keep in mind that there are no trade ticks when working with multi-leg option orders, so natural pricing based on bid and ask is used.

Triggers can activate orders when a bid or ask occurs at a specific price (Single Bid/Ask) or requires two bids and asks at that level (Double Bid/Ask). Please access Help from within the TradeStation platform for more details on trigger types.

Practical applications

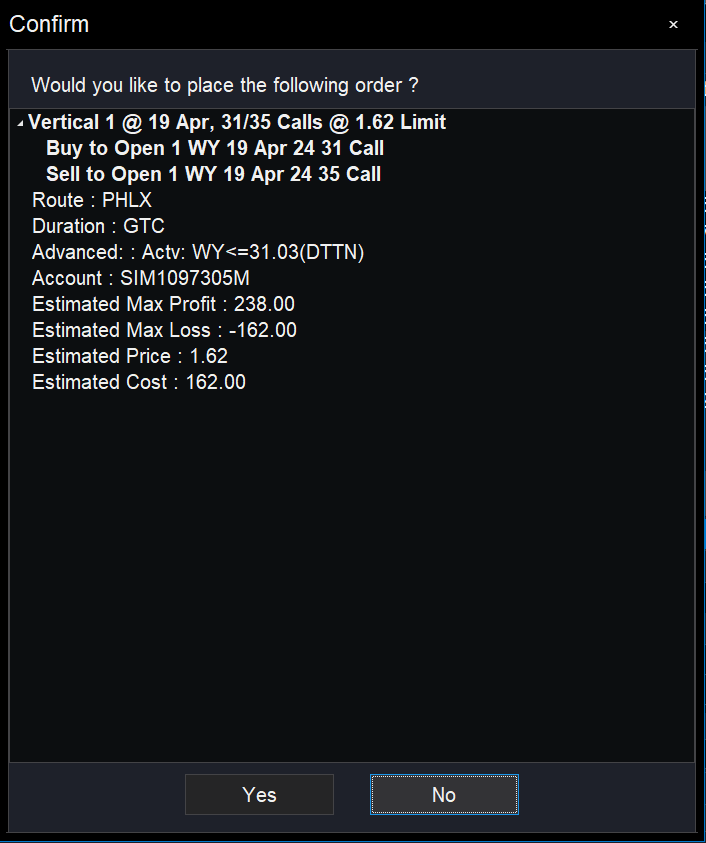

Activation rule for entry

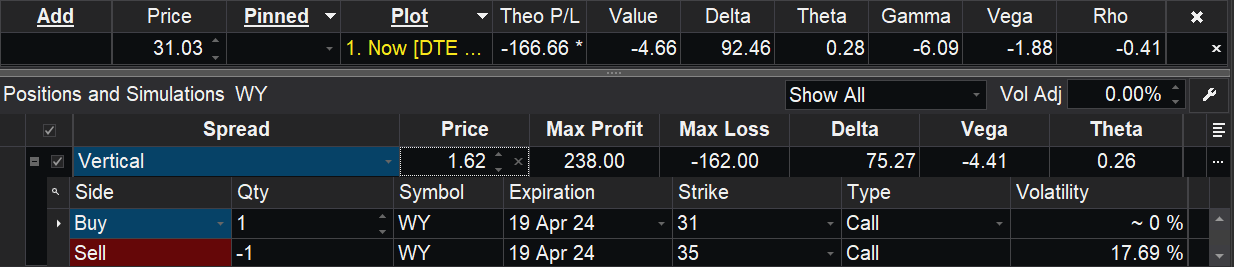

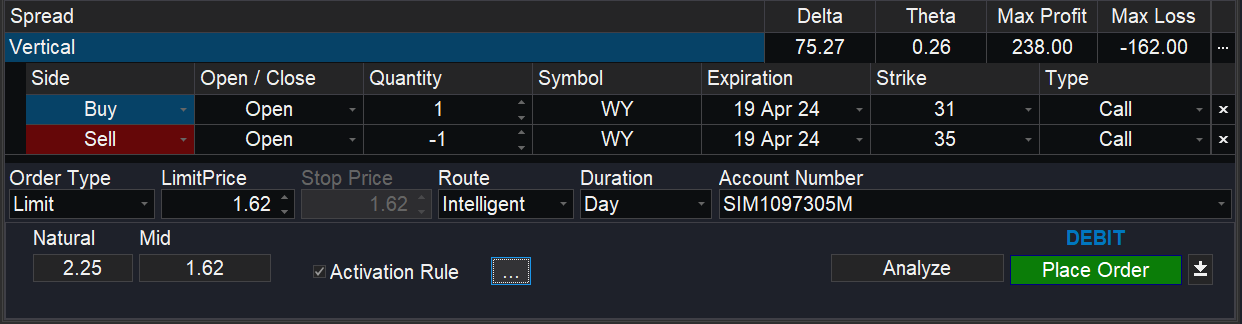

Let’s explore the activation rule features with a hypothetical, simulated options trade. Imagine our TradeStation client, Alex, believes that Weyerhaeuser Company (WY) stock is bullish. She opts for a bull call spread to control her risk and lower costs. However, the price is not currently optimal for entering the spread.

If Alex were to place the bull call spread at the current underlying price, there is a risk that the stock could drop to the demand level near $31.00. By analyzing the spread in OptionStation Pro, we can use the price slice to theorize the potential drawdown if Alex enters early and WY drops to the demand level.

The position would reach maximum loss before the price continues its bullish trend. To avoid this, Alex can delay placing the order to enter the spread until the underlying price bounces from the buying pressure near $31.00. She will use the activation rule to do it.

Alex creates the spread order as usual and then checks the box next to the activation rule. To specify the conditions, she clicks the ellipsis button to open the menu.

Within the menu, Alex creates the condition that the entry order will only be sent once the price of WY has become equal to or less than the demand level.

Once finished with the conditions, she clicks OK to add the activation rule to the entry order. To complete the process, Alex needs to click “Place Order” to route it. Before submission, she can confirm the activation rule in the order confirmation to ensure accuracy before sending it.

The order is now ready to be sent to the exchange once the price of WY has dropped into the demand level Alex identified. This is an example of using an activation rule to trigger an entry order when conditions have been met.

Bracketing positions

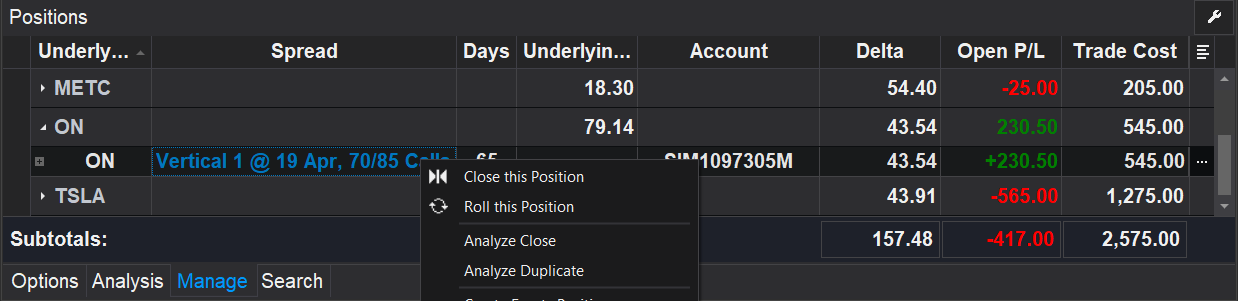

Activation rules can also be used to bracket an option position where an order is submitted to exit the position if the target or a stop loss has been reached. Consider Julio, another TradeStation client, who wants to place a bracket on his open bull call spread in ON Semiconductor Corp (ON).

Julio wants to limit his loss from the position if ON’s price breaks below the support at $70.00. He would also close the position for a profit if the price rallied to or above the resistance at $85.00.

To begin the process, Julio goes to the Positions window on the Manage tab of OptionStation Pro. Right-clicking on the open position reveals a menu where Close this Position is available.

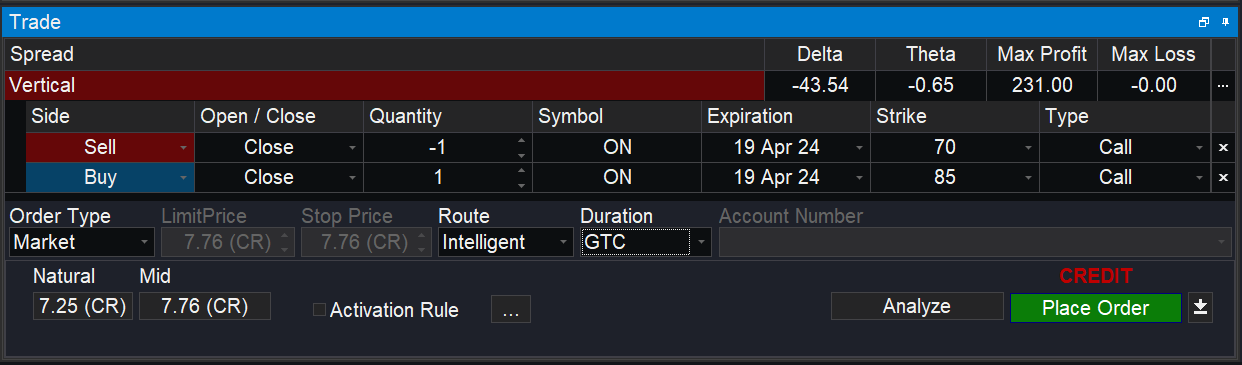

This will create an order to exit the existing options position. To increase the likelihood that the order is filled, Julio changes the order type to market and the duration to GTC. Now, he can set the activation rules by checking the activation rule box and clicking the ellipsis to open the menu.

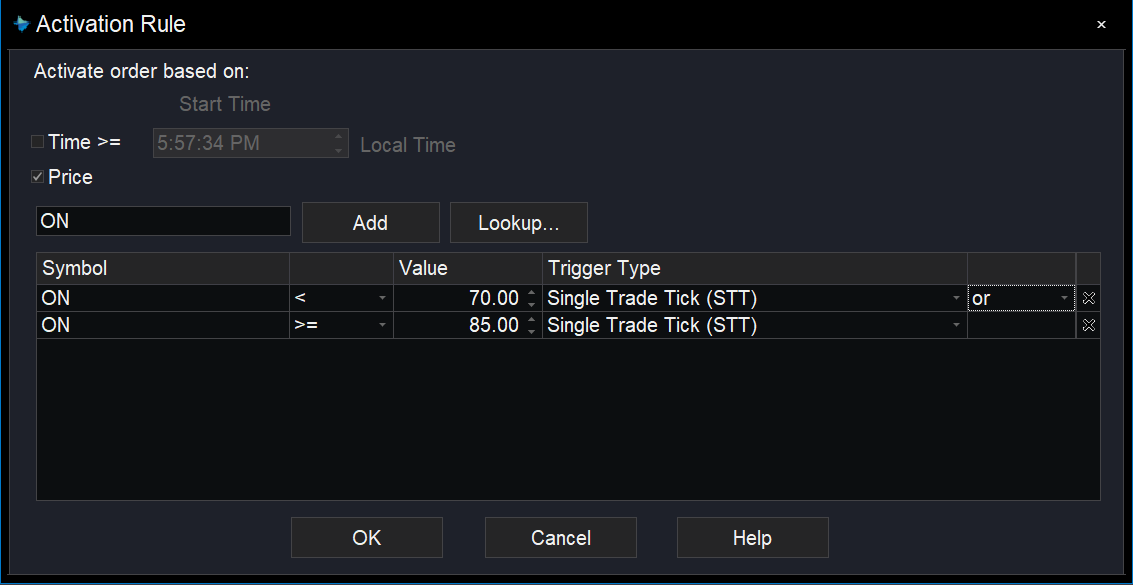

In the menu, Julio must add the stock symbol twice since there are both a stop loss and a profit target trigger. The rule is configured so that if the price of the underlying moves below the support at $70.00, the market order will be sent to exit the bull call spread at the current market price. But if the price of ON rises to or above $85.00, the same market order to exit the spread would be sent.

Julio remembered to use the connector “or” between the conditions so that either condition would send the order. Had he mistakenly used “and,” the order would never have triggered as it is impossible for the stock price to be above 85 and below 70 simultaneously!

Activations on single option premiums

The activation rule can also be configured to trigger if an option’s premium reaches a specific price. Instead of entering the stock symbol into the activation rule menu, you enter the option’s symbol. The lookup button on the menu may be used to find the specific option’s symbol.

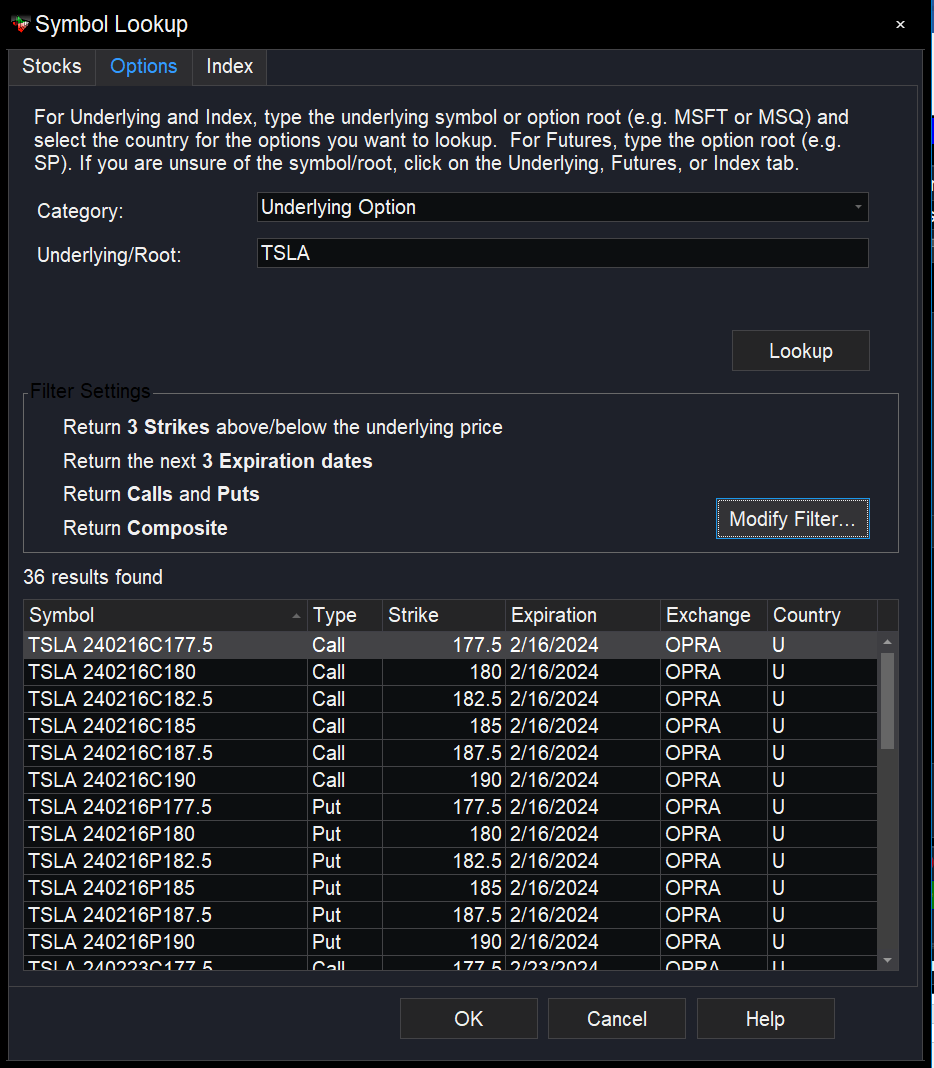

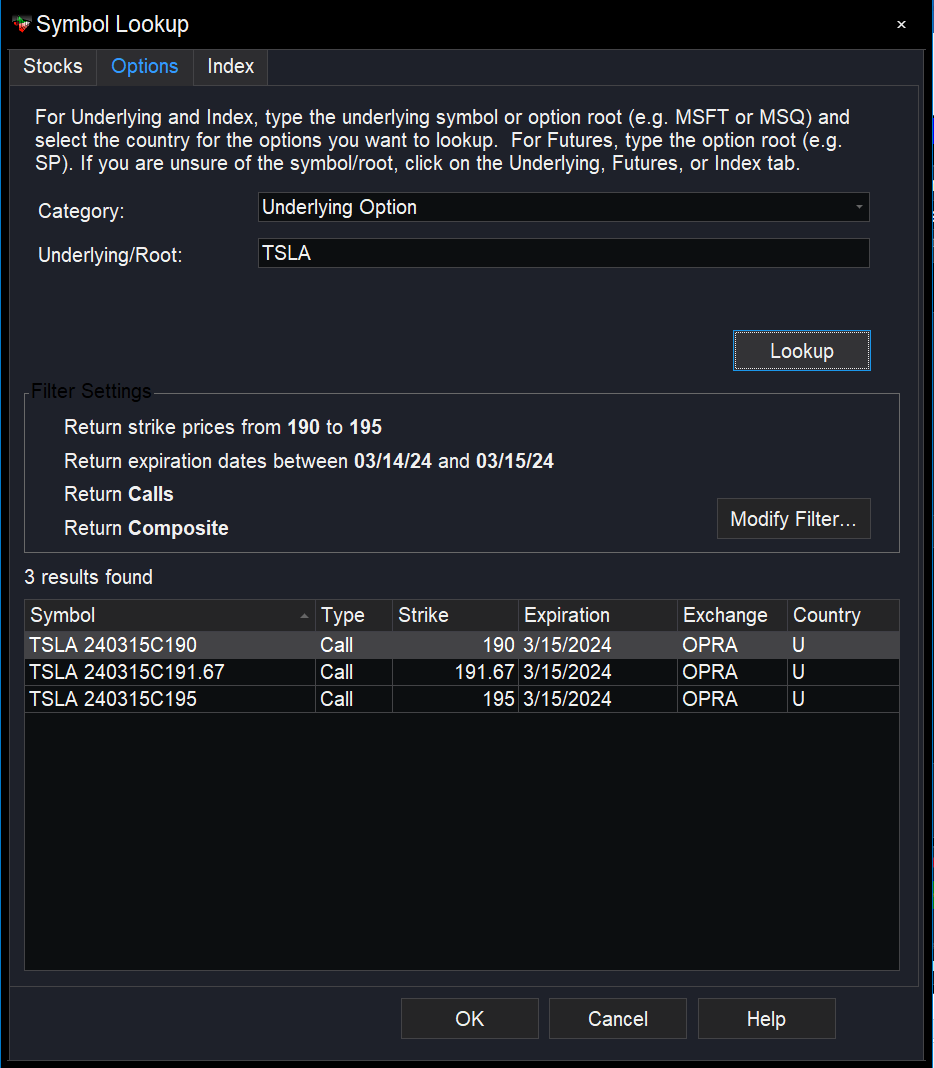

Clicking Lookup will open another menu where you can select stocks, options, or indexes. Selecting the options tab and entering the underlying symbol will list the option symbols you may use for the activation rule.

As an example, we have looked up near-expiration options for Tesla stock.

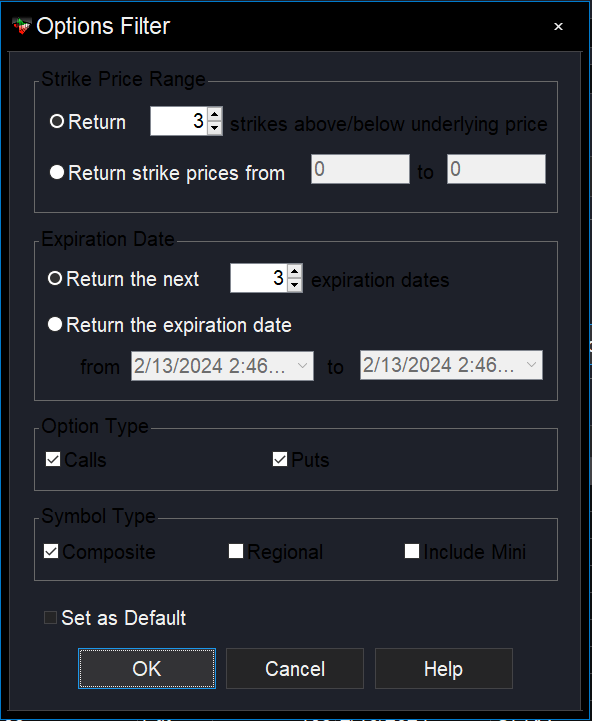

An additional option filter can filter by strike prices, expiration dates, option types, and underlying types.

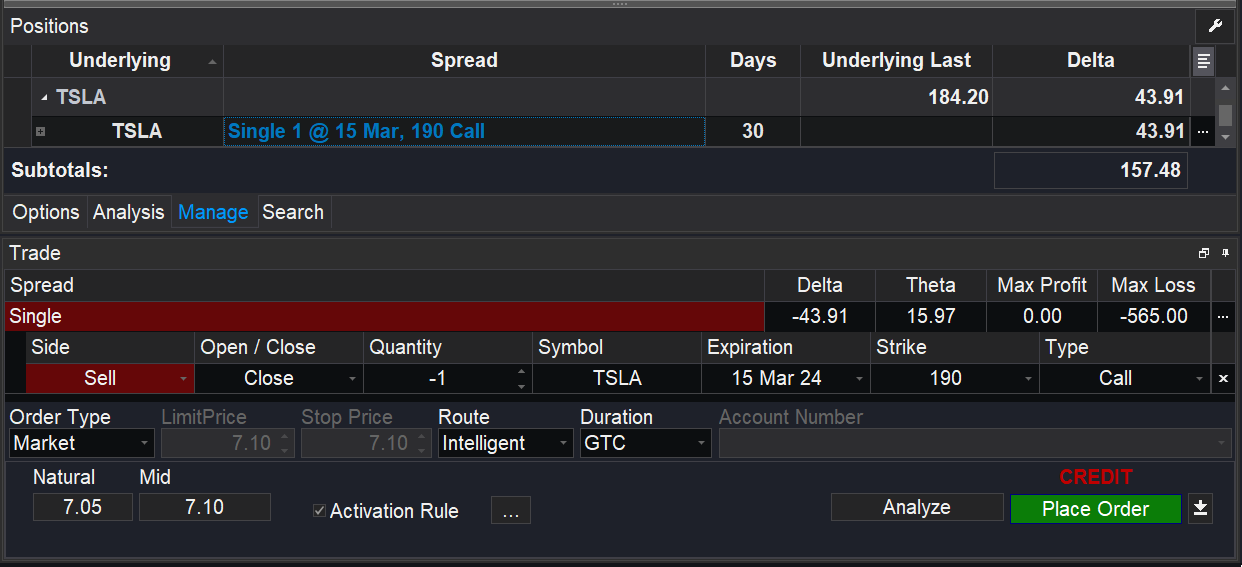

Let’s look at an example. We currently hold a long call option on TSLA. With the activation rule, we can set a stop loss and profit target order based on the option premium. Let’s initiate a closing transaction by right-clicking on the open position and selecting Close Position.

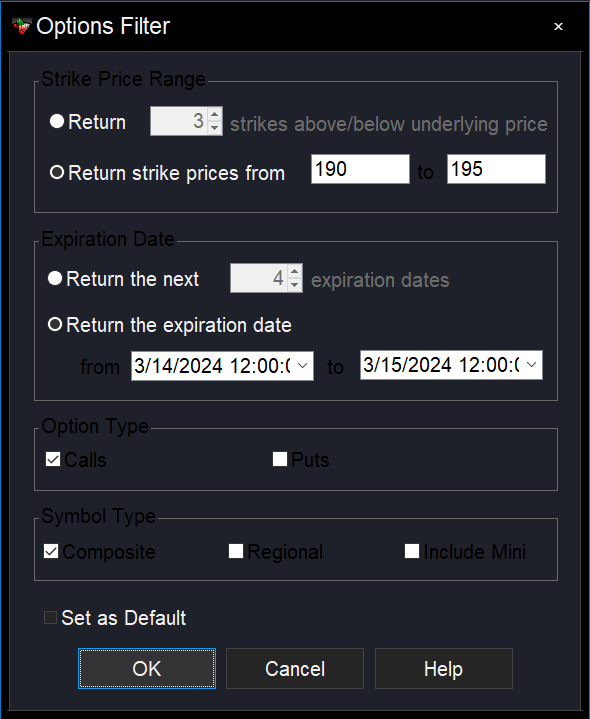

To avoid searching through many option symbols on TSLA, we modified the filter to include the specific call option for which we set the conditions. You must use different strike prices in the “from” and “to” sections and different expiration dates in the “from” and “to” area.

Click ok and then lookup to get the filter results.

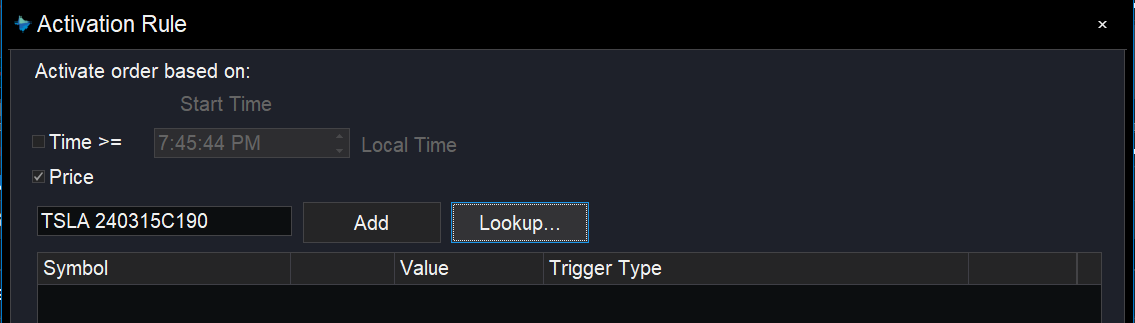

Selecting the correct option symbol and clicking ok loads the options symbol.

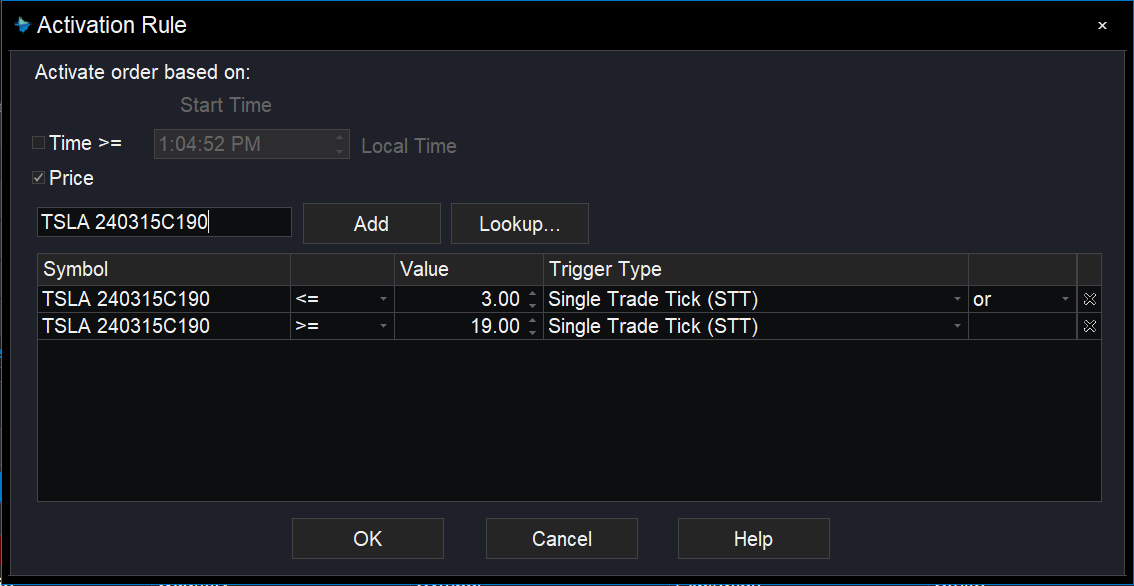

We can now add the symbol to the activation rule and set the trigger prices based on the premium. It is set the same way as a stock. Use “or” as a connector so either condition would trigger the exit order.

In this example, the trader aims to exit the long call if the premium drops to $3.00 or less for a stop loss. However, if the call premium rises to $21.00 or greater, the exit order is triggered for the profit target.

Practice

You can log onto the TradeStation platform in Simulated Trading mode. Here, you can practice placing activation rules on options orders without risking real money until you are comfortable. This will familiarize you with the order entry process.

Conclusion

TradeStation’s Activation Rule is an order feature that allows you to determine the time or price at which an order will be sent to the market. Using the activation rule on options orders automates part of the trading process and may help reduce the effect of emotions that can hurt a trader’s profitability. This automation can also assist traders by handling order routing, relieving them from constantly sitting in front of their computers monitoring market prices and time. Learning to understand how these rules work may help you trade smarter not harder.

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID3433411D324